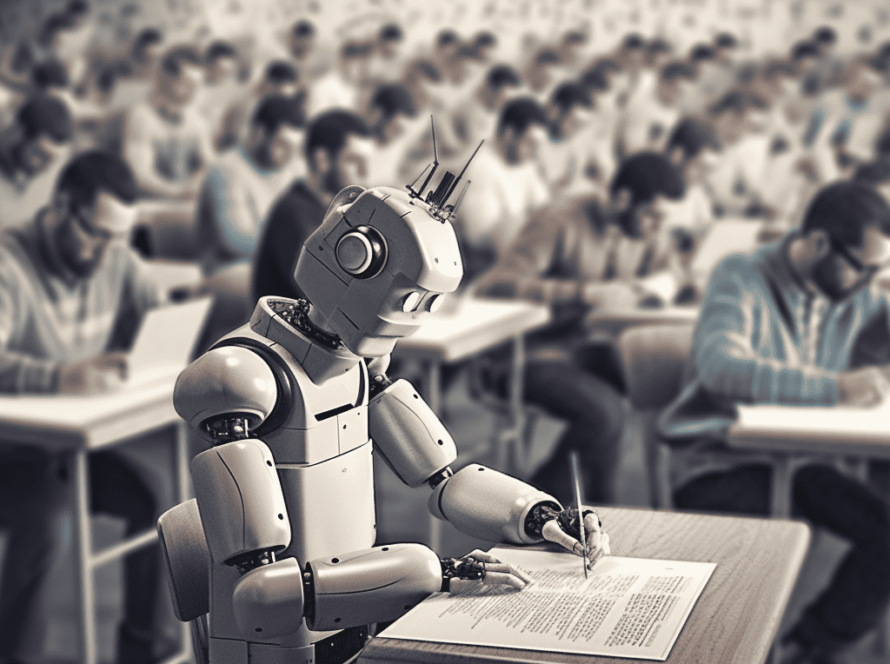

Welcome to the thrilling journey of boosting your monetary literacy with ChatGPT!

Now, the place monetary choices can have long-lasting impacts, it’s extra vital than ever to be financially literate.

ChatGPT, a cutting-edge AI language mannequin developed by OpenAI, emerges as a game-changer on this area.

On this complete information, we’ll dive deep into how ChatGPT may be your associate in mastering the artwork of economic administration.

So, let’s get into this journey to empower you with data, instruments, and methods to boost your monetary literacy.

Understanding Monetary Literacy

Monetary literacy is having a set of abilities and data that means that you can make knowledgeable and efficient choices along with your monetary sources.

It’s not simply about understanding primary monetary phrases; it encompasses a broader spectrum of understanding that helps people navigate the monetary world confidently.

Right here’s a better look:

1. Key Elements of Monetary Literacy

- Budgeting: Understanding easy methods to plan and handle your revenue and bills.

- Saving: Figuring out the significance of saving for future wants and emergencies.

- Investing: Being conscious of various funding choices and their dangers and returns.

- Debt Administration: Figuring out easy methods to handle money owed successfully, together with loans and bank cards.

- Insurance coverage: Understanding the forms of insurance coverage and the way they defend in opposition to monetary dangers.

- Retirement Planning: Planning for retirement, understanding pension plans, 401(ok)s, IRAs, and different retirement instruments.

2. Why is Monetary Literacy Vital?

- Empowers People: Monetary literacy empowers folks to make knowledgeable monetary choices, keep away from pitfalls, and perceive the implications of their actions.

- Promotes Monetary Well being: It results in higher monetary well being, like elevated financial savings, diminished debt, and a greater credit score rating.

- Reduces Monetary Stress: Understanding funds can considerably scale back anxiousness and stress associated to cash.

- Prepares for Life’s Modifications: It prepares people for all times occasions comparable to shopping for a house, saving for schooling, or retirement.

3. Challenges in Attaining Monetary Literacy

- Advanced Monetary Merchandise: The rising complexity of economic merchandise makes it more durable for the typical particular person to grasp.

- Lack of Training: Many individuals lack entry to primary monetary schooling.

- Evolving Monetary Tendencies: Maintaining with the continually evolving monetary tendencies and rules may be difficult.

4. Enhancing Monetary Literacy

- Training and Assets: Using instructional sources, like books, programs, and on-line platforms, together with AI instruments like ChatGPT.

- Sensible Expertise: Gaining sensible expertise via budgeting, investing, and different monetary actions.

- Searching for Skilled Recommendation: Consulting monetary advisors for extra advanced monetary choices.

5. The Position of Expertise in Monetary Literacy

- Accessibility of Info: Expertise, particularly AI instruments like ChatGPT, makes monetary data extra accessible.

- Interactive Studying: AI and on-line platforms supply interactive and personalised studying experiences.

- Actual-Time Help: AI instruments present real-time assist and suggestions, making the educational course of extra environment friendly.

Monetary literacy is a vital ability in in the present day’s world, impacting virtually each side of life.

From managing each day bills to planning for retirement, a stable basis in monetary literacy is vital to reaching monetary safety and independence.

Instruments like ChatGPT supply a singular alternative to boost this data in an interactive, personalised, and accessible method.

The Position of ChatGPT in Monetary Training

1. Offering Accessible Monetary Info

- On the spot Responses: ChatGPT presents speedy solutions to a variety of economic queries, from primary ideas to advanced methods.

- Broad Information Base: It attracts from an enormous pool of economic information, making certain that the knowledge it supplies is complete and numerous.

2. Customized Monetary Steering

- Tailor-made Recommendation: ChatGPT can supply personalised monetary recommendation primarily based on the consumer’s distinctive monetary state of affairs and targets.

- Interactive Studying: It engages customers in interactive conversations, making the educational course of extra participating and efficient.

3. Enhancing Monetary Literacy

- Explaining Advanced Ideas: ChatGPT simplifies advanced monetary terminologies and ideas, making them simpler to grasp for novices.

- Situation-Primarily based Studying: It will probably simulate numerous monetary situations, serving to customers to grasp the potential outcomes of various monetary choices.

4. Budgeting and Expense Monitoring

- Finances Creation: ChatGPT can help in making a finances by analyzing revenue and bills and suggesting optimum budgeting methods.

- Expense Evaluation: It will probably assist monitor and analyze spending patterns, offering insights for higher monetary administration.

5. Funding and Wealth Administration

- Funding Training: ChatGPT educates customers about various kinds of investments, their dangers, and potential returns.

- Portfolio Strategies: Whereas not an alternative to skilled monetary recommendation, it may well supply common steerage on portfolio diversification and administration.

6. Debt Administration and Credit score Training

- Debt Technique Growth: ChatGPT can recommend methods for managing and paying off money owed successfully.

- Credit score Rating Enchancment Suggestions: It supplies insights into how credit score scores work and presents suggestions for enhancing them.

7. Actual-Time Monetary Updates and Insights

8. Entry to World Monetary Views

- Worldwide Finance: ChatGPT can supply insights into international monetary markets, serving to customers perceive worldwide funding alternatives and dangers.

9. Bridging the Monetary Training Hole

- Accessible to All: It presents a free or low-cost approach for people to entry monetary schooling, no matter their background or revenue stage.

- Language and Cultural Sensitivity: ChatGPT can work together in a number of languages, making monetary schooling extra accessible to non-English audio system.

10. Steady Studying and Adaptation

ChatGPT’s position in monetary schooling is multifaceted and profoundly impactful. It democratizes entry to monetary data, tailors studying experiences, and supplies a platform for steady monetary studying and exploration.

Whether or not for budgeting, investing, debt administration, or understanding advanced monetary ideas,

ChatGPT stands as a useful useful resource for anybody seeking to improve their monetary literacy and make extra knowledgeable monetary choices.

Part 1: Private Monetary Administration with ChatGPT

Budgeting and Expense Monitoring

- ChatGPT-Assisted Budgeting: Find out how ChatGPT will help you create a finances tailor-made to your revenue and bills. It will probably recommend budgeting strategies, monitor bills, and supply insights into your spending patterns.

- Expense Evaluation: ChatGPT can analyze your spending habits and supply ideas for cost-cutting, making certain a extra environment friendly allocation of sources.

Debt Administration and Credit score Rating Enchancment

- Navigating Debt with AI: Uncover how ChatGPT can information you in managing and paying off money owed. It will probably present methods tailor-made to various kinds of debt, from bank cards to scholar loans.

- Credit score Rating Insights: ChatGPT can educate you on components affecting your credit score rating and supply suggestions to enhance it, which is essential for monetary well being.

Part 2: Investing and Wealth Administration with ChatGPT

Fundamentals of Investing

- Funding Training: Grasp the fundamentals of various funding autos like shares, bonds, and mutual funds via interactive conversations with ChatGPT.

- Danger Evaluation Instruments: ChatGPT will help assess your danger tolerance and recommend funding methods accordingly.

Retirement Planning

- Planning for the Future: Find out about retirement planning, together with 401(ok)s and IRAs, and easy methods to make knowledgeable choices for a safe future.

- Portfolio Administration Steering: ChatGPT can present insights on portfolio diversification and rebalancing methods to optimize your retirement financial savings.

Part 3: Using ChatGPT for Superior Monetary Ideas

Understanding Taxation

- Tax-Associated Queries: ChatGPT can make clear taxation ideas and help in understanding numerous tax varieties and deductions.

- Strategic Tax Planning: Uncover methods for tax effectivity in investments and revenue, guided by ChatGPT’s huge data base.

Actual Property and Mortgage Recommendation

- Navigating the Housing Market: Achieve insights into the true property market, mortgage choices, and the house shopping for course of with ChatGPT’s help.

- Mortgage Calculations: Make the most of ChatGPT to grasp mortgage calculations, rates of interest, and the impression of varied mortgage phrases in your funds.

Part 4: Personalizing Monetary Studying with ChatGPT

Custom-made Studying Experiences

- Interactive Studying: ChatGPT presents a customized studying expertise, adapting to your data stage and monetary targets.

- Situation-Primarily based Studying: Interact in simulated monetary situations to use your studying in real-life-like conditions.

Staying Knowledgeable and Up to date

- Market Tendencies and Information: ChatGPT retains you up to date on the most recent monetary information and market tendencies, serving to you make knowledgeable choices.

- Steady Studying: As monetary markets evolve, ChatGPT continues to study, offering you with up-to-date data and techniques.

Conclusion

ChatGPT is extra than simply an AI software; it’s a companion in your monetary literacy journey.

By leveraging its capabilities in budgeting, investing, superior monetary ideas, and personalised studying, you’re nicely in your technique to turning into financially savvy.

Keep in mind, monetary literacy is not only about understanding cash; it’s about making knowledgeable choices that result in monetary freedom and safety.

With ChatGPT by your aspect, you’re geared up to navigate the advanced world of finance with confidence and ease.