The mixing of synthetic intelligence (AI) into enterprise is important, particularly for firms aiming to stay aggressive. The enterprise of mergers and acquisitions (M&A) isn’t any exception. AI is already remodeling M&A processes by rising effectivity, mitigating dangers, and uncovering new alternatives.

The excessive stakes challenges of M&A

Dealmakers are required to handle info and knowledge of a number of stakeholders in excessive stress, time delicate environments. They need to account for any variety of dangers, together with ongoing geopolitical, regulatory, or monetary uncertainties. In truth, danger evaluation is predicted to be essentially the most difficult facet of the deal course of within the coming yr.

Given the present atmosphere, dealmaking is extra complicated than ever. Consumers are more and more targeted on conducting thorough due diligence and gaining deeper insights into goal firms earlier than shifting ahead. Sellers, in flip, are anticipated to offer higher transparency, reflecting a extra discerning method to dealmaking. The time required to arrange a deal has elevated by 27% within the Americas within the first half of 2024 in comparison with the identical interval in 2023, whereas the time required to finish due diligence has additionally grown. Moreover, the quantity of content material in digital knowledge rooms—a essential part of the due diligence course of—has surged considerably per deal in comparison with final yr. Dealmakers have additionally mentioned that unrealistic expectations round resourcing and bandwidth is the most important cause why offers have fallen aside within the final two years.

AI in M&A

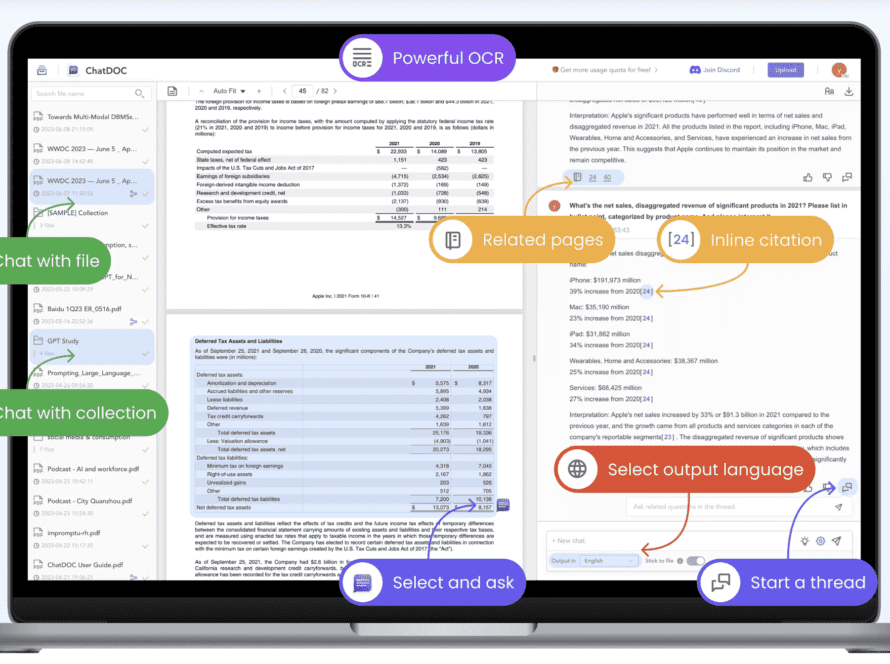

AI helps dealmakers navigate these challenges. AI and and generative AI can automate lots of the handbook, time-consuming duties which are essential to the due diligence course of. For example, AI can streamline the group and categorization of recordsdata wanted for overview by traders or patrons, lowering human error and guaranteeing compliance with regulatory necessities.

By automating repetitive duties, AI may also permit dealmakers to deal with strategic choices. For example, AI-powered redaction instruments can speed up the method of figuring out, blocking, and unblocking delicate info as a deal progresses, thereby streamlining doc administration and enhancing productiveness. This automation allows dealmakers to allocate extra time and sources to higher-value actions, finally enhancing the general effectivity and effectiveness of the M&A course of.

AI can be making different elements of the dealmaking course of extra environment friendly. Some of the essential steps in M&A is figuring out potential targets. AI can help on this course of by analyzing datasets and market traits, which is especially helpful for firms pursuing programmatic M&A methods. Some AI-powered instruments can analyze anonymized personal, paid and public knowledge and different transaction actions inside a safe platform, serving to dealmakers determine higher and sooner deal targets.

As well as, AI can assist within the valuation course of by offering goal analyses primarily based on historic knowledge and market elements. Nonetheless, whereas AI enhances accuracy and effectivity in valuations, human judgment stays important, significantly in evaluating qualitative elements and forecasting. The synergy between AI and human experience is essential for reaching balanced and knowledgeable decision-making.

Dealmakers need to use AI instruments within the M&A course of. In truth, two thirds of world dealmakers mentioned exploring the usage of new AI instruments is their prime space of operational focus subsequent yr, and most see elevated productiveness as a major advantage of AI of their enterprise, dashing up offers by as a lot as 50%. But there are some gaps that should be bridged between AI data and its utility.

A big quantity of dealmakers say knowledge safety and privateness considerations are the most important obstacles to incorporating AI into their companies and a majority need the know-how regulated.

AI adoption is rising and dealmakers might want to be sure that their enterprise fashions are primed to leverage it to achieve a aggressive edge. This includes not solely integrating AI to extend effectivity but in addition making use of sharper insights to enhance deal outcomes. Attaining a steadiness between AI and human experience is essential to maximizing productiveness and guaranteeing profitable M&A transactions.