Fraud and cybersecurity threats are escalating at an alarming price. Companies lose an estimated 5% of their annual income to fraud. The digital transformation of monetary providers, e-commerce, and enterprise safety has created new vulnerabilities that cybercriminals exploit with rising sophistication. Conventional safety measures, which depend on static rule-based methods, usually fail to maintain up with quickly evolving fraud ways. Handbook fraud detection processes are sluggish, vulnerable to human error, and incapable of analyzing huge quantities of information in real-time.

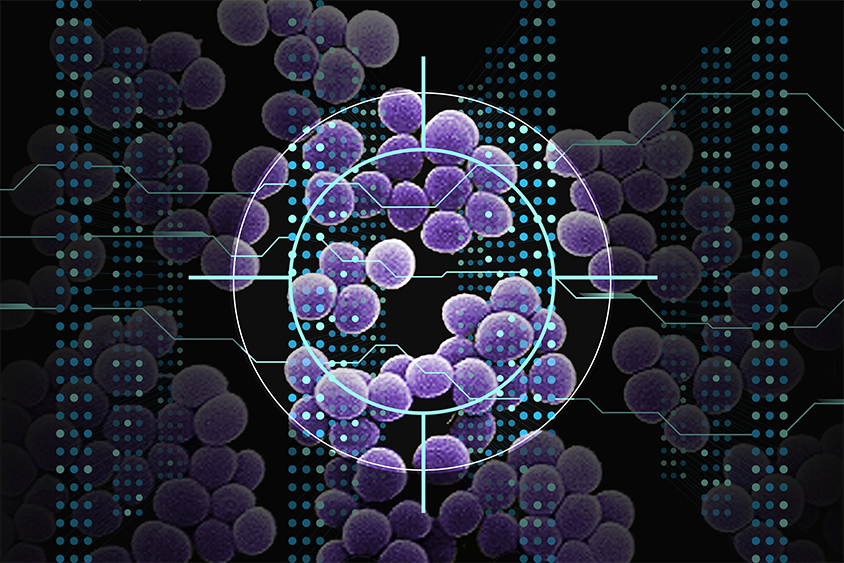

Synthetic Intelligence (AI) has emerged as a game-changer in fraud detection and safety. Not like typical safety methods that rely upon predefined guidelines, AI-powered safety brokers analyze billions of transactions per second, establish advanced fraud patterns, and adapt autonomously to new cyber threats. This has led to the widespread adoption of AI-driven safety options in banking, e-commerce, healthcare, and enterprise cybersecurity. AI’s skill to detect and neutralize fraud earlier than it occurs is genuinely reworking safety and making monetary transactions, consumer accounts, and company networks considerably safer.

The Function of AI Brokers in Cybersecurity and Fraud Prevention

Safety and fraud detection has come a good distance, shifting from sluggish, handbook processes to good, AI-driven methods that make selections in real-time. Up to now, detecting fraud meant going via information by hand, which took time, led to errors, and sometimes missed new threats. As digital transactions turned extra frequent, rule-based methods had been launched. These methods used set guidelines to flag suspicious exercise, however they had been inflexible, resulting in too many false alarms that interrupted respectable transactions and annoyed prospects. As well as, they wanted fixed handbook updates to maintain up with new kinds of fraud.

AI-powered fraud detection has modified the paradigm by making methods extra clever and responsive. Not like older rule-based fashions, AI brokers scan large quantities of information immediately, recognizing patterns and strange conduct at terribly excessive velocity. These brokers are constructed to work inside safety methods, continually studying and bettering without having human enter.

To catch fraud successfully, AI brokers pull in information from a number of sources. They evaluation previous transactions to seek out something uncommon, observe consumer conduct like typing velocity and login habits, and even use biometric information like face recognition and voice patterns for additional safety. Additionally they analyze gadget particulars reminiscent of working system and IP tackle to verify a consumer’s identification. This combine of information helps AI detect fraud because it occurs fairly than after the very fact.

One in every of AI’s greatest strengths is making selections in real-time. Machine studying fashions course of hundreds of thousands of information factors each second. Supervised studying helps detect recognized fraud patterns, whereas unsupervised studying picks up on uncommon exercise that doesn’t match typical conduct. Reinforcement studying permits AI to regulate and enhance its responses based mostly on previous outcomes. For instance, if a financial institution buyer all of a sudden tries to switch a big quantity from an unfamiliar location, an AI agent checks previous spending habits, gadget particulars, and placement historical past. If the transaction seems dangerous, it could be blocked or require additional verification via multi-factor authentication (MFA).

A big benefit of AI brokers is their skill to continually refine their fashions and keep forward of fraudsters. Adaptive algorithms replace themselves with new fraud patterns, characteristic engineering improves predictive accuracy, and federated studying allows collaboration between monetary establishments with out compromising delicate buyer information. This steady studying course of makes it more and more troublesome for criminals to seek out loopholes or predict detection strategies.

Past fraud prevention, AI-driven safety methods have grow to be an integral a part of monetary establishments, on-line cost platforms, authorities networks, and company IT infrastructures. These AI brokers improve cybersecurity by figuring out and stopping phishing scams, scanning emails for malicious hyperlinks, and recognizing suspicious communication patterns. AI-powered malware detection methods analyze recordsdata and community site visitors, figuring out potential threats earlier than they trigger hurt. Deep studying fashions additional improve safety by detecting new cyberattacks based mostly on refined system anomalies.

AI additionally strengthens entry management by monitoring login makes an attempt, detecting brute-force assaults, and using biometric safety measures like keystroke dynamics. In circumstances of compromised accounts, AI brokers rapidly establish uncommon conduct and take fast motion—whether or not meaning logging the consumer out, blocking transactions, or triggering extra authentication measures.

By processing huge quantities of information, repeatedly studying, and making real-time safety selections, AI brokers are reshaping the way in which organizations fight fraud and cyber threats. Their skill to detect, predict, and reply to dangers earlier than they escalate is making digital environments safer for companies and shoppers alike.

Actual-World Purposes of AI Safety Brokers

AI safety brokers are being actively utilized in numerous real-world situations to boost cybersecurity and fraud detection.

American Specific (Amex) makes use of AI-driven fraud detection fashions to investigate billions of every day transactions, figuring out fraudulent actions inside milliseconds. By using deep studying algorithms, together with Lengthy Quick-Time period Reminiscence (LSTM) networks, Amex considerably enhances its fraud detection capabilities. In accordance with a case examine by NVIDIA, Amex’s AI system can generate fraud selections quickly, considerably bettering the effectivity and accuracy of their fraud detection course of.

JPMorgan Chase employs AI safety brokers to scan real-time monetary transactions, detect anomalies, and establish potential cash laundering actions, with their AI-powered Contract Intelligence (COiN) platform decreasing fraud investigation instances from 360,000 hours per yr to seconds.

Constructing on these developments, PayPal makes use of AI-powered safety algorithms to investigate purchaser conduct, transaction historical past, and geolocation information in real-time. These superior algorithms assist detect and stop fraudulent actions successfully. In a associated effort to guard customers, Google’s AI-driven cybersecurity instruments, together with Protected Shopping and reCAPTCHA, present sturdy defenses towards phishing assaults and identification theft, blocking a major proportion of automated assaults.

Challenges, Limitations, and Future Instructions of AI Brokers in Safety and Fraud Detection

Whereas AI brokers provide important developments in safety and fraud detection, in addition they include their challenges and limitations.

One of many major issues is information privateness and moral issues. The deployment of AI brokers includes processing huge quantities of delicate info, elevating questions on how this information is saved, used, and guarded. Companies should be certain that they adhere to strict privateness rules to stop information breaches and misuse. The moral implications of AI selections additionally must be thought-about, particularly in situations the place biased algorithms could result in unfair remedy of people.

One other problem is the prevalence of false positives and negatives in AI-driven detection. Whereas AI brokers are designed to boost accuracy, they aren’t infallible. False positives, the place respectable actions are flagged as fraudulent, can result in inconvenience and distrust amongst customers. Conversely, false negatives, the place fraudulent actions go undetected, can lead to important monetary losses. Effective-tuning AI algorithms to attenuate these errors is an ongoing course of that requires steady monitoring and updating.

Integration challenges additionally pose a major hurdle for companies seeking to undertake AI brokers. Integrating AI methods into present infrastructures could be advanced and resource-intensive. Firms want to make sure that their present methods are appropriate with AI applied sciences and that they’ve the required experience to handle and keep these methods. Moreover, there could also be resistance to alter from workers who’re accustomed to conventional strategies, necessitating complete coaching and alter administration methods.

Regulatory points additional complicate the scenario for AI-driven safety and fraud detection. As AI applied sciences repeatedly evolve, so do the rules governing their use. Companies have to be prepared to make sure compliance with the most recent authorized necessities. This consists of adhering to information safety legal guidelines, industry-specific rules, and moral tips. Non-compliance can lead to extreme penalties and injury to an organization’s repute.

Trying to the longer term, a number of rising applied sciences have the potential to remodel the sector of AI in safety and fraud detection. Improvements reminiscent of quantum computing, superior encryption methods, and federated studying are anticipated to boost the capabilities of AI brokers.

Predictions for the way forward for AI brokers in safety and fraud detection point out that these applied sciences will grow to be more and more superior and widespread. AI brokers will seemingly grow to be extra autonomous and able to making selections with minimal human intervention. Enhanced collaboration between AI and human analysts will additional enhance the accuracy and effectivity of safety measures. Furthermore, the mixing of AI with different rising applied sciences, reminiscent of blockchain and IoT, will present complete safety options.

Companies have many alternatives to put money into AI-driven safety measures. Firms that put money into cutting-edge AI applied sciences can achieve a aggressive edge by providing superior safety options. Enterprise capital corporations and traders are additionally recognizing the potential of AI on this subject, resulting in elevated funding for startups and innovation. Companies can capitalize on these alternatives by partnering with AI expertise suppliers, investing in AI analysis and growth, and staying forward of {industry} traits.

The Backside Line

AI safety brokers are basically reworking how companies defend towards fraud and cyber threats. By analyzing huge quantities of information in real-time, studying from rising dangers, and adapting to new fraud ways, AI is offering a stage of safety that conventional strategies merely can’t match. Firms like American Specific, JPMorgan Chase, and PayPal are already utilizing AI-driven safety to guard monetary transactions, buyer information, and company networks.

Nonetheless, challenges like information privateness, regulatory compliance, and false positives stay key issues. As AI expertise continues to evolve, with developments in quantum computing, federated studying, and blockchain integration, the way forward for fraud detection and cybersecurity seems extra sturdy than ever. Companies that embrace AI-driven safety options immediately will probably be higher outfitted to remain forward of cybercriminals and construct a safer digital world for his or her prospects.